Save $1,000s with a novated lease

Unlock massive savings & reduce your taxable income

See how much you will save

Novated lease pricing is unique as it's based on your salary, how many kilometres you drive, insurance, what state you live in and ultimately what car you choose...

You can get your quote online or by speaking to one of our expert Australian based consultants.

Dandi W

Top service, above and beyond

Reagan has gone above and beyond to make it as easy and as straightforward as it can be. This isn't my first Novated Lease, but definitely the best...

David

Sean Edema at NLA was excellent

Sean Edema at NLA was excellent.

He was informative, efficient and accessible.

I recommend his services highly.

Joshua A.

5 stars for NLA!

I cannot recommend Payton and NLA enough if you are looking for a novated lease. Even if you don’t end up going with NLA they should be your first conversation....

Electric Cars

Thanks to the Australian Governments major fringe benefits tax incentive for EVs and PHEVs under $89,332 the value on offer is insane. Often it's working out better than paying cash.

Here are some of the most popular eligible vehicles.

100%

Customer Satisfaction

Popular EV

Tesla Model Y

Pay using your pre-tax salary

The payments on your TESLA MODEL Y will be made from your salary before tax is deducted. You can also pay for car running costs this way to maximise the savings.

GST Savings

You’ll also save thousands on the purchase price of your TESLA MODEL Y thanks to the GST tax credit available on a novated lease. You can save up to a maximum of $6,191 in GST (cars up to $68,108 in FY 2023/24 – above this amount, the GST saving is capped at $6,191).

You can benefit from GST savings on your packaged car running costs too.

Electric Vehicle FBT Excemption

If that wasn't enough, you can also take advantage of the federal government's fringe benefits tax (FBT) exemption for zero and low emission vehicles on eligible TESLA MODEL Y variants below the luxury car tax threshold ($89,332 for EVs/PHEVs in 2022/23 financial year).

This means you could save thousands more on the cost of the vehicle itself AND eligible running costs.

The LCT threshold includes dealer delivery and accessories, but excludes stamp duty, registration, insurance and service plans.

How does a novated lease work?

Like a traditional car loan, there are finance repayments over a fixed term, with a residual (or balloon) payment due at the end of the lease which is set within the ATO guidelines. Each party to the agreement – employer, employee, and financier – will play a specific role.

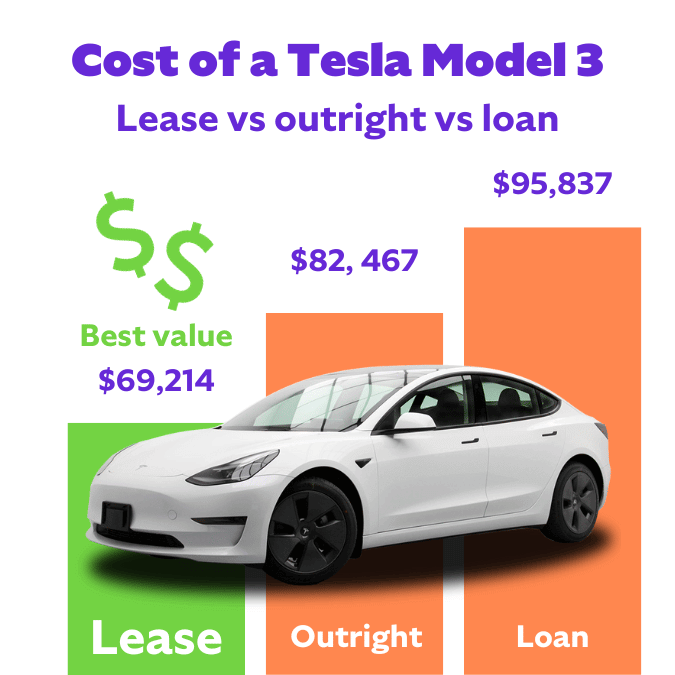

Huge extra EV savings

The new legislation on EV's and PHEV's states that cars under $89,332 are exempt from fringe benefits tax.

This dramatically increases the savings available under a novated lease agreement when buying an eligible EV or PHEV.

This example shown is the cost of buying and running a Tesla Model 3 RWD over 5 years, compared to using traditional car finance and buying the car outright using cash. (The calculation is based on a driver in NSW with $120,000 pre-tax salary, 15,000km driven annually and car loan interest rate of 7.5% p.a.)

Non-EVs

We also help customers every day with fantastic deals and major tax savings on Australia's best-selling non-EVs.

Quick-fire novated lease questions

Learn more about how a novated lease works from start to finish. Our expert consultants can also answer any questions, so you can sign up with confidence.

Can I buy a used car with a novated lease?

Yes, right now, people more than ever are getting used cars through a novated lease instead of waiting for a new car deal. Buying a used car from a dealership will still see you save the GST on the purchase price.

Is there a minimum salary to get novated lease?

Novated leasing approval is dependent on your capacity as a borrower much like traditional finance. This means you need to illustrate your ability to meet regular repayments over the term of the lease.

For example, as it is entirely dependent on your personal living situation, expenses and dependents, you could gain approval for a $30,000 vehicle on a yearly salary of $45,000.

What's the minimum and maximum value of car I can get?

The amount you can borrow for a vehicle will vary depending on the lender. In general, the minimum novated lease amount is between $5,000 and $10,000, while higher amounts are subject entirely to the repayment capacity of the applicant.

Novated lease agreements may exceed $100,000 but very rarely exceed $150,000.

Get expert answers to more of the common questions in our novated lease explained guide.

How long will my novated lease be?

The term of the lease agreement is flexible, to suit the employee.

Generally, terms of one to five years are available under a novated lease. The shorter the term of the salary packaging agreement, the higher the residual.

What happens at the end of a novated lease?

You have a few options available at the end of your novated lease term:

- Pay the residual amount (including GST) at the end of the lease term to own the car outright.

- Sell the car (either privately or through a dealer) and if the sale price is higher than the residual amount owing, you get to keep the profit tax free.

- If you want to keep the same car and continue enjoying the tax savings, we can help you to refinance the residual amount for another term.

What happens if I leave my current job during a novated lease?

If you leave your job during the term of your novated lease, or are fired from your position by the employer, you will still be responsible for making payments on the vehicle.

The lease will be de-novated, where the running costs are removed from the agreement and repayments work much the same way as a standard car loan.

Can I get a novated lease if I work for my own company

A novated lease can be suitable for a business owner who is also an employee of their own company, but it’s only an option if the business owner is receiving a salary from the company they own.

If you are planning to leave your current employment to start your own business, you can transfer your novated lease, provided you are paying yourself a salary.

If you are self-employed – i.e. are not paid a salary or paying yourself a salary through your own company – you will need to look at alternative forms of vehicle finance.

Novated Lease Guides

Need more information? Read our easy-to-understand novated lease guides.