Is a novated lease worth it?

Novated Leasing Explained: Top 20 Questions Answered (simply)

Get a quick quote to see how much you could save

Have you heard about novated leasing but been put off by how complicated it sounds?

If you want novated leasing explained simply, with no jargon, read on as Novated Lease Australia answers some of the questions we’re most commonly asked by clients. We also explains the meaning of some of the novated lease terminology you may encounter.

Dandi W

Top service, above and beyond

Reagan has gone above and beyond to make it as easy and as straightforward as it can be. This isn't my first Novated Lease, but definitely the best...

David

Sean Edema at NLA was excellent

Sean Edema at NLA was excellent.

He was informative, efficient and accessible.

I recommend his services highly.

Joshua A.

5 stars for NLA!

I cannot recommend Payton and NLA enough if you are looking for a novated lease. Even if you don’t end up going with NLA they should be your first conversation....

Top 20 Questions

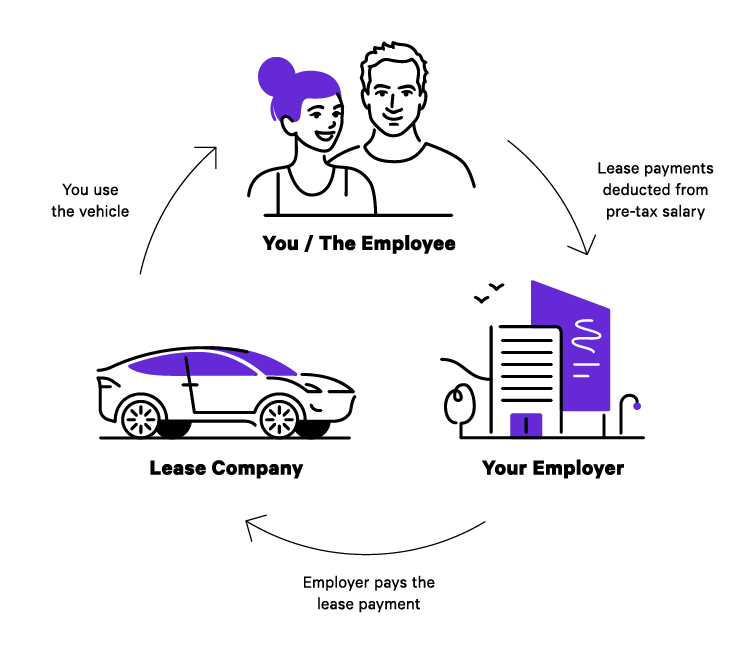

Can you explain novated leasing for me simply?

A novated lease is a way to financing a new or used car and paying for its running costs while saving money on tax. This is because the finance payments and contributions towards running costs are made by your employer from your pre-tax salary.

‘Salary sacrificing’ in this way reduces your taxable income and means you pay less in tax. This is one of the main benefits of a novated lease.

With a novated lease, you also do not have to pay GST on the purchase price of the car (a saving of up to $6,191), and your car running expenses will be GST-free too.

What's the process for getting a novated lease set up?

Here’s a super quick explanation of what's involved:

- You lease a car from a finance company with the help of a novated leasing provider.

- The novated lease provider arranges a quote for you that includes your finance payments and budgets for the running costs based on the kms you expect to drive each year.

- Your employer deducts the lease payment and running cost amount from your salary.

- You can use the vehicle 100% for personal use, with the option to own the vehicle when the lease term ends.

How do I qualify for a novated lease?

To qualify for a novated lease the only requirements are that you are employed and paid through the PAYG system. Your employer also needs to offer novated leasing as a benefit, or be willing to start offering it.

Can I get a novated lease if I’m not on a very high income?

Yes you can. As long as you pay tax, there is still a tax benefit, no matter what your income is. And that's just the income tax. There's also the GST which comes off the purchase price of the car, plus the GST savings on the running expenses as well.

Do you need to be driving your car a lot to benefit from a novated lease?

Even if your mileage is low, you still get a significant tax benefit compared to what you would get alternatively (e.g. with a car loan or buying the car outright).

But if you are travelling more kilometres, the benefit of doing the lease versus not increases because of how much you'd otherwise be spending out of your own pocket on running expenses without the tax benefit.

What kind of vehicle can I novate?

Novated leasing is available for passenger vehicles, so it’s mainly cars, SUVs and utes. For commercial vehicles, the payload needs to be under a tonne, which rules out a lot of commercial vans.

How old can a second-hand car be if I want to get a novated lease?

With a novated lease on a used car, the age limit goes up to 15 years at the end of the lease term. So for a five-year lease, the vehicle can’t be older than 10 years old at the start of the lease.

Can I get a novated lease for a car I already own?

Yes, this is relatively common. Most people want to get a new car, but there are some people who have recently purchased a car and then became aware of novated leasing and want to get the benefits.

It's a simple process. Essentially, the finance company buys the car from you and you lease it back from them (known as ‘sale and lease back’). The only difference is you miss out on the GST benefit on the purchase price, but the income tax savings will be the same. Plus, you still get the GST savings on your car running expenses.

Can I novate more than one car?

Yes, you can. As long as you are able to service the finance, you can do multiple novated leases. One of my recent customers had three: one for himself, his wife and son.

If I get a novated lease, who owns the car?

The finance company owns the car during the novated lease term. That being said, the car is registered in your name, you have full personal use of it, and you have the option to pay off the car to own it outright at the end of the lease term.

This is why cars acquired through a novated lease are not always eligible for EV government incentives and rebates, as actual ownership does not transfer to you until the end of the lease.

Will there be a credit check when I apply?

Yes, most lenders will do a credit check when assessing your application for credit. However, it is still possible to be approved for a novated lease if you have bad credit.

What car running costs can I include?

I usually explain to people it's pretty much any cost to maintain the vehicle and keep it on the road. These are the main costs that can be included:

- Fuel or electricity if it’s an electric vehicle

- Insurance

- Servicing

- Tyres

- Registration/CPT

- Carwashes

- Roadside assistance

Are there any running costs I can’t include?

You can't include costs that are not related to maintaining the vehicle and keeping it on the road. That means the likes of tolls or parking costs cannot be included.

What happens if I change employers during the novated lease term?

You can transfer your novated lease over to your new employer. We do this for clients all the time, as long as the new employer is happy to take on the lease.

If a new employer doesn't want to take it on, you can make the finance payments directly yourself (from after-tax salary) and look after the running expenses yourself.

What happens if I go on unpaid leave during my novated lease term?

It’s a good idea to contact your novated lease provider to discuss options. But generally the finance lease payments will continue even if you’re not earning a salary for a period. If there are surplus funds in your expense account, the payments can be made using that money. You can also deposit additional funds into your account to cover the payments while you’re not earning.

If I include running costs, can I pick my own insurance provider?

Yes, absolutely. We can help of course, but everyone is free to source their own insurance. You set up the policy and we include the cost in the lease budget and reimburse customers so they're still getting the tax benefit.

If you pay the insurance premium monthly, we'll reimburse monthly. If it’s annual, we'll reimburse the annual amount from your account.

You’ll also need to send us a copy of your policy documents as confirmation that your vehicle is insured, as that is a condition of the novated Lease.

How are the car running expenses calculated?

We estimate them at the start of the lease based on how much you think you’ll drive per year. But we can change those running costs at any time throughout the term.

If you're overspending compared to the budget, we readjust those figures to cover the extra mileage. If you overestimate, we can dial the expenses back to bring the payments down. But in that scenario, most people leave the extra paid as a buffer in the account in case something comes up.

At the end of the term, we refund the account balance back to the employer to pay to you as taxable salary.

What will I need to do when the lease ends?

It’s pretty straightforward. We send you a payout letter from the lender explaining how much the residual value of the vehicle is. This is the amount required as a final payment for you to own the car outright.

What people most commonly do at that point is sell the car and use the sale funds to pay out the residual amount and keep any profit tax free. Then they start again with a new lease on a new car.

The other options are to pay the residual and keep the car, or re-lease the vehicle for another 12, 24 or 36-month term.

Can I pay extra towards my residual value during the lease?

In a word, no. This is because the minimum residual amount that must be paid in order for you to own the car at the end of the lease is set by the ATO. Paying extra during the term would bring the residual below the ATO’s minimum.

Likewise, you are not allowed to put any remaining funds in your novated lease account towards the residual at the end of the lease. You must pay the residual (including GST) with after-tax money.

How long will my novated lease last?

Novated lease terms are generally between 1 and 5 years and you will be able to choose a term that suits your situation best. Most people go with a 5-year term.

More of our Guides

Novated Leasing Explained: Top 20 Questions Answered (simply)

Have you heard about novated leasing but been put off by how complicated it sounds? If you want novated leasing explained simply, with no jargon, read on as Novated Lease Australia answers some of...

Novated lease vs Chattel Mortgage

Want to compare a novated lease against a chattel mortgage? Depending on your situation there are a few different ways you can purchase a new car: You could buy it outright You can take out a c...

Novated lease pros and cons Understanding the pros and cons of a novated lease is essential to deciding whether salary packaging is the best way for you to finance a vehicle. While a novated le...