Is a novated lease worth it?

Novated Lease Pros and Cons

How much is the car you wish to novate?

Dandi W

Top service, above and beyond

Reagan has gone above and beyond to make it as easy and as straightforward as it can be. This isn't my first Novated Lease, but definitely the best...

David

Sean Edema at NLA was excellent

Sean Edema at NLA was excellent.

He was informative, efficient and accessible.

I recommend his services highly.

Joshua A.

5 stars for NLA!

I cannot recommend Payton and NLA enough if you are looking for a novated lease. Even if you don’t end up going with NLA they should be your first conversation....

Novated lease pros and cons

Understanding the pros and cons of a novated lease is essential to deciding whether salary packaging is the best way for you to finance a vehicle.

While a novated lease provides benefits for employees and employers, there are a few potential downsides that could make it unsuitable in some situations.

Here’s a quick overview of the main advantages and disadvantages. Then, if you want to dig into it a bit more, we’ve explained each of these pros and cons in more detail below, so you can decide if a novated lease will be worth it for you.

At a glance...

Novated lease pros

- Vehicle can be used 100% for personal use

- Bulk discounts on vehicles available

- GST saving on car purchase (plus accessories and add-ons)

- Use pre-tax salary for repayments

- Bundle car-running costs into your pre-tax repayments

- Save GST on car running costs

- EVs and PHEVs are exempt from fringe benefits tax (this can increase your savings by thousands more)

- Lease a new or used car

- Lease can be transferred to a new employer if you move job

- Flexibility at the end of the lease term

Novated lease cons

- You may need to agree to your employer’s choice of leasing company

- Only available to salaried employees

- Not all employers offer it as a benefit

- You don’t own the car until the end of the lease

- Slightly more complicated than other finance options

- Not as flexible for making extra repayments

- Novated leasing is subject to fringe benefits tax (FBT) as are all employee benefits

- Some vehicles are not eligible (e.g. non-passenger vehicles)

- There’s extra complexity if you move job

- There’s a residual payment to cover at the end of the lease

Is a novated lease worth it?

Yes, for a lot of people a novated lease is very much worth it.

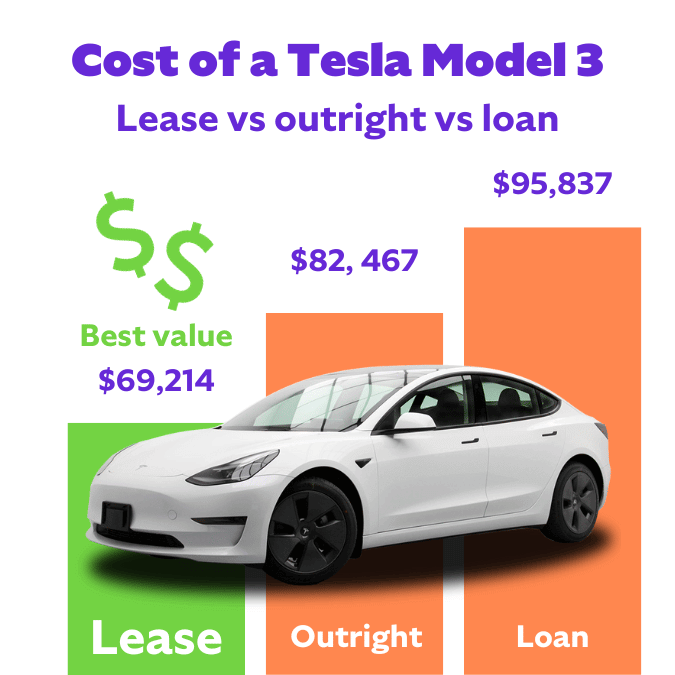

In fact, it could save you more than $13,000 versus buying a car outright with cash and more than $26,000 compared to using a car loan (see example).

This is a massive saving for everyday Australians at a time when the cost of living is a big worry.

The tax advantages become even more of a draw if you are buying an eligible EV or PHEV which qualifies for no FBT.

The cost comparison shown is based a 2023 Tesla Model 3 RWD, with ongoing car running costs factored into the calculation.

The calculation assumes a driver in NSW with an annual pre-tax salary of $120,000, a car loan interest rate of 7.5% p.a., car running costs based on 15,000km driven per year, and a 5-year novated lease term. Car running costs include insurance, registration, servicing and tyres.

The potential cost savings will be different for each lease and will depend on:

- The car you buy

- Your income

- Your running costs (based on how much you drive)

- The duration of the lease

Novated lease advantages in more detail

1. Vehicle can be used 100% for personal use

The novated lease payments on the vehicle are deducted by your employer from your salary. But that’s where the connection to your employer ends. You can use the vehicle entirely for personal use, with no need to keep a record of how you use it.

2. Bulk discounts on vehicles

The novated lease payments on the vehicle are deducted by your employer from your salary. But that’s where the connection to your employer ends. You can use the vehicle entirely for personal use, with no need to keep a record of how you use it.

3. GST saving on car purchase

If you buy your car through a novated lease, you will save on GST on the purchase price of the vehicle, plus any extras and accessories included in the up-front cost (tow bars, roof racks, window tinting etc.).

The total potential GST discount on a car purchase (including extras) is capped at $6,191. With private sales there is generally no GST saving as it’s usually not added to the sale price by the seller.

4. Use pre-tax salary for repayments

When it comes time to make repayments for your vehicle, this will be done by your employer using your pre-tax salary. This reduces the amount of income you need to pay tax on and can mean savings in the thousands of dollars depending on the lease repayment amount and your salary.

5. Cover car-running with pre-tax money

You can boost your tax savings further by bundling your car running costs into your lease repayment as well. This includes fuel, servicing, insurance, registration and tyres. This is also handy as it means you won’t need to separately budget for your car running costs. The novated lease company will help you work out your running costs when calculating your novated lease.

6. Save GST on car running costs

Any car running costs that are included in your lease will also come with a GST saving, bringing yet more tax savings. Say, for example, you spend $100 per week on fuel. With the GST savings, you would save over $470 per year on your fuel costs, or around $2,300 over a 5-year novated lease term. And, you can still use your supermarket discount coupons.

7. EVs and PHEVs are exempt from fringe benefits tax

If you buy an eligible electric vehicle (EV) or plug-in hybrid electric vehicle (PHEV) through a novated lease, it will be exempt from fringe benefits tax. This applies to EVs and PHEVs with a purchase price below the luxury car tax threshold ($89,332 for the 2023/24 financial year).

A recent Novated Lease Australia study found that 84% of Australians believe the price of electric vehicles is too expensive and a major barrier to switching their vehicle to an EV. The FBT exemption is designed to reduce that barrier.

8. Novated lease a new or used car

You have the flexibility to finance the purchase of a new vehicle or you can get anovated lease for a used car, provided it’s not more than 15 years old at the end of the lease. For a used car, it can be one you buy through a dealer or private sale.

9. Lease can be transferred to a new employer if you move job

Just because your lease was set up through your current employer, it doesn’t mean it needs to stay there. You can either transfer it to your new employer or de-novated it and continue to make the repayments yourself using after-tax money like a regular car loan.

10. Flexibility at the end of the lease term

When the novated lease term comes to an end you have the option to:

- extend the lease to a new term with the same car by refinancing the novated lease residual value

- pay out the residual value of the vehicle to own the car outright

- pay the residual and sell the vehicle with any profit being yours, tax-free

Novated lease disadvantages in more detail

1. You may need to agree to your employer’s choice of leasing company

Many employers who offer novated leasing have an agreement with a particular leasing company. If that’s the case, you won’t have the option of shopping around for a better offer.

At Novated Lease Australia we believe ‘Exclusive Provider’ contracts are outdated.

“If you deliver the best service and competitive pricing, why do you need one?” said founder Shaun McGowan.

“Every day we see examples of our pricing being thousands of dollars cheaper than an employer’s preferred provider but employees are forced to use the exclusive provider. This shouldn’t be the case. After all, this is an employee benefit and employees should be entitled to get the best deal.”

- Shaun McGowan

2. It’s only available to salaried employees

A novated lease is only an option for employees. If you’re self employed you won’t be able to finance a car with a novated lease.

3. Not all employers offer it as a benefit

Most government departments offer novated leasing to employees and it's becoming increasingly common in the private sector too, but it’s not available from all employers. If your employer doesn’t offer it, you’ll need to look at other finance options.

4. You don’t own the car until the end of the lease

Unlike a car loan or buying the car outright with cash savings, with a novated lease you won’t actually own the car until you pay the residual amount (which includes GST) at the end of the lease. You’ll still be able to use the vehicle without restriction but you generally won’t be able to make any modifications, except for adding tow bars and other accessories.

For this reason some of the EV incentives offered by state governments in Australia are not available through a novated lease.

5. Not as flexible for making extra repayments

Your repayments and lease term are fixed meaning you won’t have the option to make extra repayments to pay off the car faster.

6. Novated leasing is subject to fringe benefits tax (FBT)

Unless you buy an eligible EV or PHEV, your novated lease will be subject to fringe benefits tax. With a novated lease though, we reduce the FBT payable by making post-tax contributions towards your lease payments called the employee contribution method). So it’s all taken care of for you and you’re still making significant overall savings.

7. Some vehicles are not eligible

Only passenger vehicles designed to carry a load of less than 1,000kg can be financed with a novated lease. Generally vehicles like motorcycles, caravans and boats are not eligible for the tax advantages available through a novated lease.

8. There’s a bit of extra complexity if you move job

If you change jobs you’ll either need to arrange for your new employer to take on the lease (assuming they offer novated leasing) or start making the lease payments yourself from your own funds (without the generous tax savings). Similar to a standard car loan, there’s a risk of losing the car if your job is unexpectedly terminated and you can’t afford the repayments.

9. There’s a residual payment to cover at the end of the lease

All novated leases come with a residual amount. This is a large one-off payment you’ll need to make at the end of the lease term to own the car outright. It will be outlined in your lease agreement but can still come as a bit of a shock when the payment falls due. GST is payable on the residual amount and you will need to pay it using after-tax funds.

10. Slightly more complicated than other finance options

Overall, the trade off for the tax advantages of a novated lease is that it’s not as straightforward as some of the other ways you can finance a car. That said, the novated lease provider will do most of the work for you and explain the process.

Before your go...

If you want to see how much a novated lease could save you based on your circumstances, you can get a free, no-obligation quote from Novated Lease Australia.

More of our Guides

Novated Leasing Explained: Top 20 Questions Answered (simply)

Have you heard about novated leasing but been put off by how complicated it sounds? If you want novated leasing explained simply, with no jargon, read on as Novated Lease Australia answers some of...

Novated lease vs Chattel Mortgage

Want to compare a novated lease against a chattel mortgage? Depending on your situation there are a few different ways you can purchase a new car: You could buy it outright You can take out a c...

Novated lease pros and cons Understanding the pros and cons of a novated lease is essential to deciding whether salary packaging is the best way for you to finance a vehicle. While a novated le...